The Three Financial Pillars Every Title IV School Should Build Into Their Accounting System

Running a Title IV-accredited career school—whether in cosmetology, barbering, esthetics, health, HVAC, or another trade—means juggling financial compliance, operational goals, and accreditation requirements. But when it comes to accounting, most schools aren't taught how to build systems that prevent audit findings before they happen.

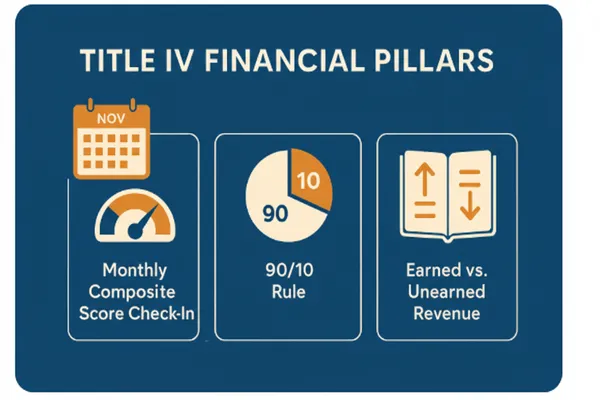

After working with dozens of Title IV schools, I’ve seen a pattern. Most financial issues fall into one of three core areas: composite scores, 90/10 rule compliance, and unearned revenue tracking. These three aren't just line items in your audit—they’re warning lights that federal regulators, accreditors, and auditors all monitor closely.

This isn’t an all-inclusive list, but if you’re looking for a starting point to redesign your school’s accounting around compliance, this is where to begin.

1. Monthly Composite Score Check-Ins

Financial Health Can’t Wait Until Year-End

The DOE’s composite score measures your school’s financial health using three ratios:

Primary Reserve Ratio (your liquidity),

Equity Ratio (your solvency), and

Net Income Ratio (your profitability).

These aren’t abstract numbers—they determine whether your school is considered financially responsible. If your score falls below 1.5, you could face restrictions. Drop below 1.0, and you risk HCM status or losing Title IV eligibility altogether.

Why monthly matters:

Many schools wait until audit season to calculate the composite score. By then, it’s too late to fix anything. Monthly monitoring lets you spot declines early—like when lease liabilities affect the equity ratio, or a net loss begins to pull the score down.

Practical example:

If a school leases a new building in August and doesn't properly account for the Right-of-Use asset and liability under ASC 842, the Equity Ratio can tank by December. But if they calculate the composite score every month, they can adjust before the audit.

What to do:

Build a composite score calculator into your month-end close.

Tie it to your trial balance or financial statements.

Flag and investigate score drops early.

Use it as part of your management review, not just your audit prep.

2. Tracking the 90/10 Rule

Revenue Mix Can Make or Break Accreditation

The 90/10 rule requires that at least 10% of a school’s revenue come from non-federal sources. Fail the test two years in a row, and the DOE can revoke your Title IV eligibility.

For cosmetology and other vocational schools, where most students utilize Pell Grants or Direct Loans, this presents a significant challenge.

Why it's critical:

Many schools don’t know their 90/10 ratio until the auditor calculates it—and by then, it’s locked in. Worse, some schools track revenue based on deposits rather than earned income, leading to misstatements.

Practical example:

A school might run a short private-pay course in December and count the full $5,000 collected as non-Title IV revenue. But if the course doesn’t finish until January, only a portion is earned in the current fiscal year. That small timing issue could push you over the 90% line—or not.

What to do:

Set up class tracking in QuickBooks or your accounting software.

Separate Title IV and non-Title IV revenue streams.

Reconcile revenue timing with earned hours, not deposits.

Monitor your ratio quarterly and simulate year-end estimates.

Tip: Consider building diversified income streams—retail product sales, CEU workshops, or short-term boot camps—that are truly outside of Title IV funding and tracked separately.

3. Earned vs. Unearned Revenue Tracking

When You Get Paid Isn’t the Same as When You Earn It

Federal funds are disbursed upfront, but schools earn that revenue over time as students complete clock hours. Misunderstanding this difference can lead to major audit findings—especially related to R2T4, refunds, and unearned revenue liabilities.

Why it matters:

Failing to track earned revenue properly can cause:

Overstated income,

Incorrect A/R balances,

Refund errors, and

DOE findings during program reviews.

Practical example:

A student receives a $10,000 Title IV disbursement in July but only completes 200 of 1,500 hours before withdrawing. If the school doesn't track earned revenue per hour, they may fail to return unearned funds or misstate their financials. That’s a violation waiting to happen.

What to do:

Create a monthly revenue recognition schedule for each enrollment period.

Calculate earned revenue based on clock hours completed vs. total hours.

Use that data to post journal entries:

Debit: Unearned Tuition Revenue

Credit: Tuition Revenue Earned

Bonus benefit: This approach also supports clearer refund calculations and more accurate A/R tracking—especially when students are on payment plans or partially funded.

Build Systems That Align With Oversight

Title IV financial compliance isn’t just about passing an audit once a year. The Department of Education, your accreditor (like NACCAS), and your CPA are all looking for consistent, verifiable financial reporting systems.

Designing your accounting around these three pillars — composite score, 90/10 compliance, and earned/unearned revenue — isn’t just smart; it protects your funding, your reputation, and your long-term ability to serve students.

Final Note

These areas aren’t exhaustive, but they represent some of the most common—and most dangerous—compliance gaps. If your current accounting setup doesn’t allow for monthly review, segregation of revenue, or time-based recognition of tuition, it may be time to revise your workflow.

Need help building out templates, checklists, or close routines to support these three areas? Anderson Accounting & Tax, LLC specializes in helping Title IV schools prepare for audits, conduct audits, and stay compliant year-round.

Click here to learn more about our Compliance Audit Prep Academy (Cap Academy) — where we prepare accredited schools for audit success.